Troubled Waters: The NBA’s International Financial Issues

Over the course of the last nine months, the financial position of the NBA has been much discussed. Teams have incurred huge losses as a result of fans not being allowed in arenas. As I have covered here previously, game day operations is an important revenue stream for teams and losing that stream has serious financial ramifications.

The idea of expansion has drifted back into the public domain, and expansion now seems to be a proposal that Adam Silver is actively considering. This shift in tone is different to how the league regarded expansion just a few years ago. Expansion was something that the NBA would pursue if the right opportunity arose.

Every single sporting league has suffered financial losses but there have been leagues that have weathered the storm relatively well. The NFL and the Premier League have been financially robust during this time period. Both leagues have been able to keep the lights on and continue normal operating activities.

Business has been impacted in both leagues; the January transfer window in the Premier League is a great example of reduced spending. In January, $96.1m was spent on transfer fees by the entire league. Three years ago, Liverpool Football Club spent $103.1m on Virgil Van Dijk alone.

One of the key reasons for the Premier League’s ability to operate unhindered by COVID-19 is international rights. $5.3bn in overseas TV rights will fill the Premier League’s coffers in the time period 2019-2022. This is a huge amount of money, and it led me to think about the NBA’s international TV rights.

The league is often perceived as the most international of the American professional leagues. Basketball has a reach that spreads from Beijing, China to Zagreb, Croatia. It is a worldwide league, and you would expect this cultural capital to be reflected in the NBA’s overseas broadcast deals.

However, that expectation is far from the truth. Revenue from international television rights is just $450m. In contrast, domestic rights are worth $2.6bn. The differential between these numbers suggest to me that the NBA has not maximized international income to the same level that the Premier League or even the NFL has for that matter.

As we have seen in other leagues, international revenue is hugely important in levelling the playing field for teams. It will never be possible to achieve a distribution of revenue that ensures that small markets and big markets can compete to the same degree. However, parity has to remain a key objective for the NBA. The league would be significantly less valuable if small markets have no chance at winning.

The Thunder are one of the smallest markets in the NBA and would benefit greatly from an improved, beefed up international revenue stream. The NBA’s actions abroad when it comes to broadcast contracts are highly important for the Thunder. Oklahoma City will never be a draw like Los Angeles or New York but the owners having greater financial security may encourage the Thunder to take more risks.

Since the team’s inception, the Thunder ownership has been relatively conservative financially. Famously, the Thunder did not pay the tax during the team’s early years when it was contending for an NBA championship. Clay Bennett and the ownership group have been more risk-tolerant in recent years, the Thunder had the highest payroll in the league during the ‘OK3’ era. However, hard financial limits did not suddenly go out of the window; the repeater tax was something that the Thunder tried to avoid back then.

A large portion of the NBA’s revenue from overseas stems from Asia. Basketball is arguably the most widely followed sport in China. The demand for the NBA is always growing in China despite President Xi Jingping’s desire for soccer to be the dominant sport in this market. Players such as Kobe Bryant, Steph Curry and LeBron James are revered by Chinese fans. The NBA wisely leveraged this demand into a huge television deal worth $1.5bn over five years.

The deal with Tencent constitutes 66% of the NBA’s revenue from international television rights. From a purely financial perspective, this deal makes plenty of sense but when current geo-political issues are considered, this contract looks very fragile. Daryl Morey’s tweet and Adam Silver’s support of Morey drove a wedge in the league’s relationship with Tencent. To this day, the relationship is still strained.

The fallout from the tweet suggests that the NBA’s reliance on China is misjudged; relying on a partner who may opt to stop fulfilling the contract if the league displeases China is worrisome.

The other big deal that the NBA has in Asia is a broadcast arrangement in Japan with Rakuten. The league agreed this contract a few years ago at a price of $225m.

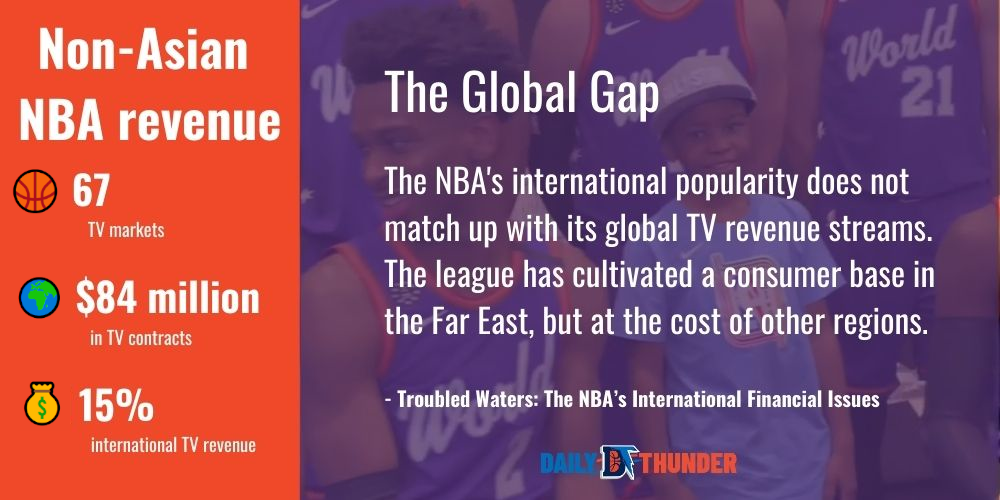

The NBA generated $450m in TV international revenue and the majority of this revenue came from Asian markets. These numbers suggest that the NBA’s focus on building a consumer base in the Far East has worked well, but these figures also suggest that the NBA has cultivated this base at the cost of other regions.

Basketball in European countries is a huge deal. Spain, France and Italy all have strong histories within the sport. Basketball is the second sport in Spain and the nation is famous for producing players such as the Gasol brothers, Serge Ibaka and Ricky Rubio. In this market, the television deal with Telefonica was worth $7.8m annually in 2020. This is a small amount when the sport’s popularity in Spain is considered.

From the research that I have conducted, it was difficult to ascertain the value of individual contracts. The NBA rarely discloses this information publicly. However from my calculations, the NBA only generates $84m from all television rights outside of China and Japan. The NBA operates in 67 TV markets besides these two countries. The amount of revenue drawn from these regions seems to be incredibly small when we consider the league’s international popularity.

I truly believe that the NBA is the most international of the Big Four American sports and that the NBA’s popularity only trails soccer. This popularity and the sheer number of European stars provide scope for maximization of revenue in Europe.

The NBA and particularly small markets such as the Oklahoma City Thunder would benefit from the financial buffer that an increase in overseas television rights would bring. This buffer would protect teams against another economic shock like COVID-19 while also encouraging ownership to be more aggressive with their roster building.

One of the reasons why teams such as the Magic ride the treadmill of mediocrity is because the team owner is afraid to tear the roster down as their bottom line takes a serious hit when fans stop turning up to watch a bad team. Additional revenue will reduce dependency on gameday income and allow owners to think about competitive success rather than just profitability.